Be that as it may. Abnormal psychology aside, what is the point that Mr. Krugman keeps making? Essentially, this: at the outset of Quantitative Easing (which always sounds to my ear like a bowel loosener), certain conservative pundits, financiers, and other riffraff confidently predicted that this "money printing" would lead to runaway inflation. They even wrote a letter, signed by many big-ass Wall Street types, to Ben Bernanke as the Chairman of the Federal Reserve, warning of the dire Weimar-like consequences that would flow from this folly. Among these financial celebrities were people like Bill Gross of Pimco (Newport Beach, CA), Cliff Asness, a hedge fund king, and Peter Schiff. I don't know if they all signed the letter (Asness did), but they have all been very vocal about hyperinflation and its current spacetime continuum whereabouts, that is, just around the corner.

Some wags have pointed out that asset prices most closely connected to QE, the housing market (since the Fed provides a secondary market for mortgages by purchasing mortgage-backed securities), and the stock market (since one aspect of QE is keeping the federal funds rate at rock bottom) have, in fact, hyperinflated. It's difficult to understand why the moribund American economy would, all by itself, push the stock market to all-time highs and restore the bubbleicious quality to the housing market last enjoyed circa 2006, when the subprime racket was in full cry. However, since the S&P 500 and the Dow, and the real estate market (by and large) are not reflected in the Consumer Price Index, Mr. Krugman's narrow point seems true: hyperinflation has not ravaged the American crapscape. I suspect that the Big Players know how to parlay ultra-cheap money into investment bonanzas; for example, a frequently cited strategy is corporate borrowing at ultra-cheap rates in order to enable a corporation to buy back its own stock, thus pushing the price higher, and then using the inflated shares as a form of additional executive compensation, a play which has the effect of exacerbating the already ludicrously skewed distribution of wealth in the U.S. and A., as Borat would say. Mr. Krugman, an academic who spends all of his time making the same monotonous point over and over again, probably does not understand how this is done, or if he is aware, does not like to acknowledge that a policy which he supports (QE) has the effect of making the rich richer, which he says he deplores.

However, on this hyperinflation point, where the fat cats barged into his macroeconomic theory kitchen, the ol' Krugster has 'em right where he wants 'em. Here's how the mighty Krugman dispatched the upstart Peter Schiff in a snarky post called "The Wisdom of Peter Schiff":

OK, leave aside the business about defining money-printing as inflation; guys, nobody cares. But what Schiff says very clearly is that according to his worldview, rolling the printing presses should cause inflation (by the normal definition) even in a depressed economy, and that high unemployment should in fact make inflation higher, not lower.

So he will write a blog post using the name of his adversary du jour in the title and, unlike his usual practice of writing a new blog every few minutes, leave it there for a week. Small, petty, vindictive? Sure, but this is a game about blog hits.

Hyperinflation was not likely to happen with QE (at least in the ordinary consumables on which the CPI is based) because of the so-called transmission mechanism. The Federal Reserve conjures money on its computer, or Ben Bernanke's iPhone, exchanges it for assets (Treasuries, MBS) in the hands of Primary Dealers (who used, after all, existing cash to buy such assets in the first place), and then "retires" such money to the excess reserve accounts of the Primary Dealers at the Federal Reserve itself. Nothing happens in this sequence which would loose this new cash into what we laughingly call these days the "real economy." No one can even tell you (least of all Mr. Krugman) why exactly we're doing QE at all. Mr. Krugman, for example, reliably informs us that interest rates would be rock bottom anyway, because of the brokeass state of the economy. Mr. Krugman also tells us that QE does not cause asset bubbles (if it did, it would enrich the fat cats, and that is inconsistent with his Conscience). So QE does not affect interest rates, it does not cause asset bubbles (it does, as noted, but Mr. Krugman is a theoretician, not J.P. Morgan) and the money just sits in excess reserve accounts because nobody really wants to borrow money from Primary Dealers or banks in general because (a) they're already up to their eyeballs in debt and (b) see (a). So why did we do QE for 5 years? Because everyone, including Mr. Krugman, is in favor of it.

Contrast this to a transmission mechanism where you mail one million smackers to each American every week. Would this result in hyperinflation? Well, yes, of course. "Running the printing presses" even in a depressed economy and distributing money by helicopter drop on the American people in such quantities would cause hyperinflation, since sellers and employers would be aware that higher prices and wages could be demanded because of the existence of all this new money in the hands of the public, and then a spiral effect of rising prices and wages would ensue, establishing new nominal levels of everything without affecting the overall position, except for the relative value of the dollar in international exchange, which would crash through the floor.

So Quantitative Easing increases the monetary base (the tally of assets held by the Federal Reserve) as a matter of definition. The Fed brings unto itself assets such as Treasury bonds and certain types of mortgage-backed securities (those with federal guarantees), and pays for these assets with credits it generates electronically, recording its payments in the excess reserve accounts of the Primary Dealers who sold the assets in question to the Fed as part of Open Market Operations.

Doing this doesn't seem to accomplish anything except generate fees and commissions for various intermediaries involved in carrying out these exchanges of cash for bonds, although it relieves (to stay with the bowel movement metaphor) Primary Dealer banks of MBS on their books which might be dodgy enough to be worth considerably less than face value to any buyer other than the Federal Reserve, which doesn't care, by and large, what anything is worth since it has the power to conjure more money at any time.

Mr. Krugman says that the money just sits in the reserve accounts, earning a princely 1/4 of one percent interest, because the economy is in a "liquidity trap." A liquidity trap exists when the Fed finds it doesn't matter how low it sets its primary lending rate, you still can't get the general public to borrow enough to get the economy moving (to "gain traction," in the buzzwords), and you can't get "firms" to borrow money to invest in capital improvements or construction which would generate growth, because there's no "demand" for more products and services in the "real economy" because everyone is brokeass. Which, as we will recall, was also the reason the public can't or won't borrow more of that money which the Fed created in the course of adding to its monetary base.

If this feels or sounds circular to you, you're not alone, because I share the sensation. Usually circularity results from using a multiplicity of entities in violation of Occam's Razor, and failing to see that one of the terms in your equation is stated twice in two different forms on both sides of the equal sign. (x+y) - LQ = (x+y) -B where LQ = B, and LQ is the Liquidity Trap and B is Brokeass. Mr. Krugman loves the term "liquidity trap" because it sounds technical. Maybe he's an amateur plumber. But a "liquidity trap" arises when the economy is brokeass and overly indebted to begin with (as the American consumer has been for a very long time), and it's just a different and confusing way of saying that when the booboisie is broke and doesn't want to add to its debts no matter how low you set the interest rate, the economy flatlines and we go nowhere but down (for most members of the booboisie, that is to say). Saying that we need to get rid of the "liquidity trap" is really the same as saying we need a prosperous middle class again in a growing economy.

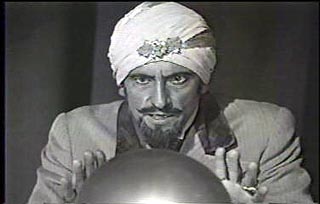

That's the way it seems to me. Swami Krugman, on the other hand, believes that America, and the world, are struggling economically because we have failed to heed the wisdom of John Maynard Keynes. We're in this liquidity trap, which is holding us back, and since monetary policy (such as QE and lowering the policy interest rate to zero, the "zero lower bound," in another buzzword phrase) doesn't work, what is left is "fiscal stimulus," where the federal government goes further into debt in order to build more roads, bridges and maybe a high-speed choo-choo. Sounds pretty good to me. And interest rates are so ridiculously low that the government can borrow the money practically for free. Who will lend to us? We will, for, as Mr. Krugman says, the national debt is basically money we owe ourselves. Indeed, the Federal Reserve is now the single largest holder of Treasuries in the world, by quite a distance. True, the Fed did not buy these Treasuries directly at auction (it's forbidden from doing so), but when QE is at full roar, the Primary Dealers who scoop up about half or more of each auction know they can unload the paper they pick up on the Fed. So do fiscal stimulus and QE all at the same time and we'll be in clover, obviously.

We need to run huge deficits, on the order of two trillion a year at least, so that lots of Treasury paper is created for the Primaries to pick up and pass on to the Bottomless Pit over at the Federal Reserve, and it won't matter whether Japan, China, Russia and Belgium (Belgium?) buy more Treasuries, which they haven't done much of lately, except for Belgium (Belgium?), because we've discovered Aladdin's Lamp all by ourselves. Nothing about this plan can go wrong, and Mr. Krugman has been urging it for many years, believe it or not, in exactly the form I'm describing here. He has urged it on Japan, for example, although Japan's national debt to GDP is already at 230%, which would translate to a national debt in the United States of at least $40 trillion.

Sometimes I ask myself this question: is Mr. Krugman completely insane? If so, I would say that he is the perfect public intellectual for this time and place in America. He wrote a highly laudatory piece about the wonders of Barack Obama for Rolling Stone recently, in which he described the O Man as one of the more "consequential Presidents" of modern times, so I assume that Mr. Krugman is positioning himself, very wisely, as a big macher in the Hillary Clinton Administration, because this is the one post, an important job in the economics department of a Democratic adminstration, which this supremely ambitious man has yet to achieve. Thus lately he has been writing (as in today's column) about the steady progress of the American economy under Barack Obama's peerless leadership.

The U.S. economy finally seems to be climbing out of the deep hole it entered during the global financial crisis. Unfortunately, Europe, the other epicenter of crisis, can’t say the same. Unemployment in the euro area is stalled at almost twice the U.S. level, while inflation is far below both the official target and outright deflation has become a looming risk.

If you've been paying attention, you might wonder how the United States climbed out of that deep hole. We didn't do what Mr. Krugman advised us to do, as outlined above. In fact, in a blog post today, he takes credit for predicting that America's ascent from the depression would be slow because the Obama stimulus was too small and too short-lived. But why did the American economy get better? Elsewhere, Mr. Krugman has informed us that economies "tend to get better over time." Well, then - maybe Washington, D.C. was using the "waiting theory" as opposed to Keynesian theory. Since it was such a devastating depression, and since Mr. Krugman has advised us (even elsewhere) that recoveries from "financial crises" tend to be slow and protracted, then maybe five years from the start of the Great Recession until now isn't really so bad. And the Waiting Theory seems to avoid the downside of Mr. Krugman's loopy counterfactual scenario - we don't go further into debt above our eyeballs in order to accomplish something which, as he admits, happens anyway.

No comments:

Post a Comment